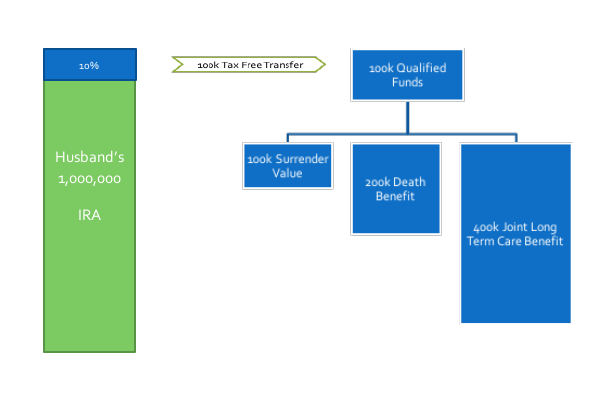

Beginning this year, the first of the baby boomers are turning age 70 and more reach that age every year. Seize the opportunity to help them protect their future using existing qualified money. Utilize the market’s only all-in-one funding solution that combines an annuity and a life insurance policy to provide LTC protection for both spouses, while maintaining an efficient tax strategy.

Show your clients how they can:

- Use qualified funds to fund their Long Term Care plan

- Spread tax liability over a 20-year period

- Satisfy RMD requirements

- Protect themselves and their spouse from LTC costs with one pool of money

- Offer flexibility of Return of Premium, Death Benefit, and leverage tax free funds for Long Term Care costs

- Guarantee performance regardless of market conditions

Mr. Client, Aged 60