Too many families are being put into dangerous territory of financial hardship and potential bankruptcy. Medical bankruptcy is the #1 leading bankruptcy in the nation and it’s only going to get worse as rising costs for health insurance rocket to dangerous levels. The sentiment felt by many can be seen in this article from Breitbart.

As insurance agents how do we solve this issue? Is there a case for helping the client and making more money in the process – YES! Many agents are doing it and you should too. The solution is to offer Personal Accident insurance in conjunction with a High Deductible Health Plan (HDHP). This allows the client to save money by moving to a bronze plan at the same time protecting themselves from an accidental event. This strategy works well for individuals and families that are relatively healthy and not plagued by medical issues. To even further protect themselves add a Hospital Recovery Plan and/or Critical Illness policy. In the end the client will have a solid plan of coverage at a reduced cost, and your commissions will increase.

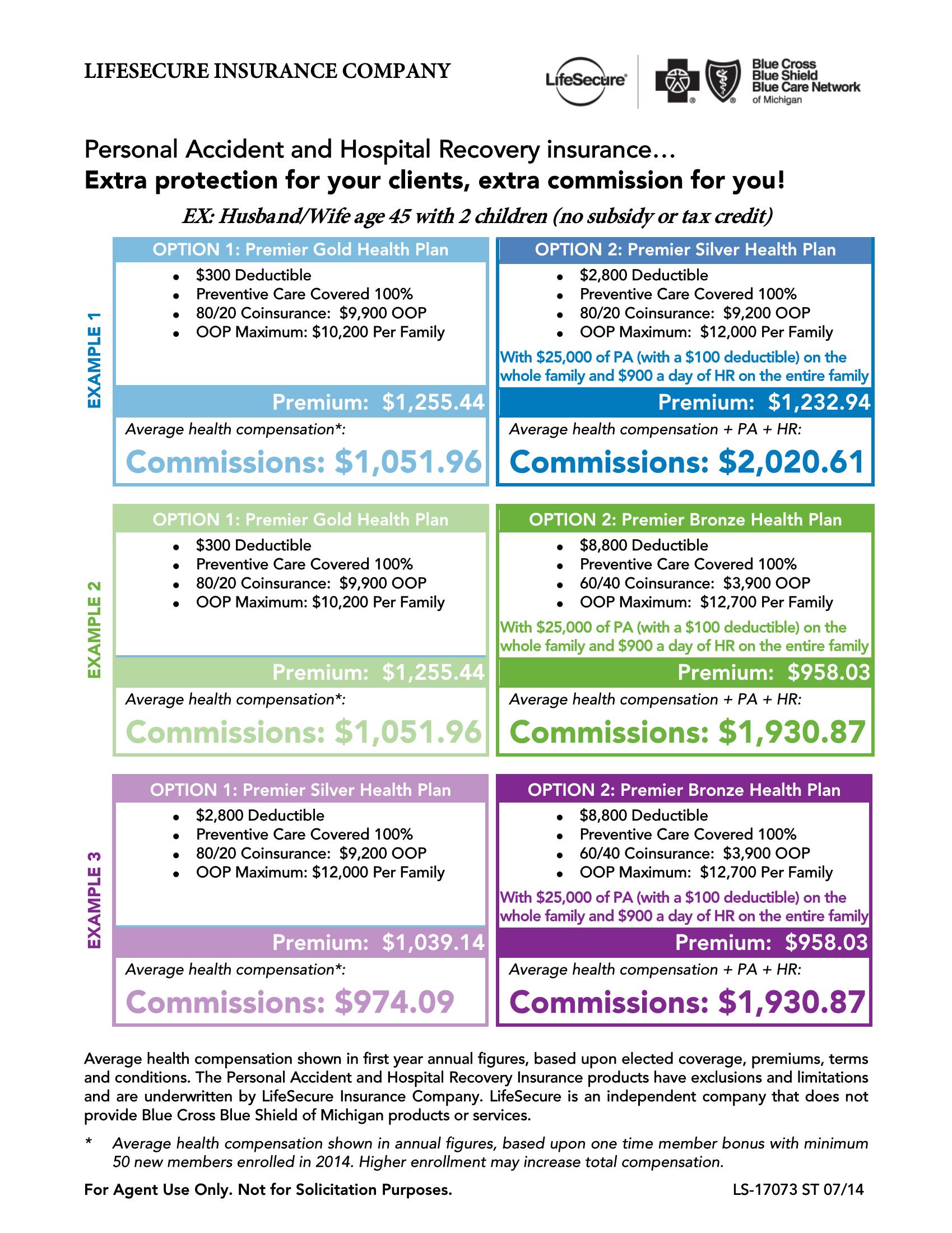

By adding a personal accident plan alone you are looking at increasing your commission by an estimated 25%. Add the Hospital Recovery and/or Critical Illness your looking at double the commissions. Check the chart below for some examples.

SALES TIP: Show the Silver plan which they are used to benefit wise first. Then break out the Bronze plan WITH the Personal Accident (“Accident Deductible Insurance”) for less cost and see which one they like better. People want to buy, not be sold. By showing the Silver plan first you position the sale to do just that. If you start with the Bronze Plan first, then you are trying to sell on top of the already high cost health plan.